2500+

Successful Projects

A typical business day at a commercial bank often feels exhausting for customers—endless paperwork, long queues, limited banking hours, and overworked staff can turn even simple tasks into a hassle. Add concerns about hygiene and covid exposure, and the experience becomes even more frustrating. This is where Bank Application Development is changing the game. With a reliable mobile banking app, busy individuals can manage their finances anytime, anywhere, while banks can operate more efficiently and serve customers better. The future of the financial industry clearly lies in digital solutions.

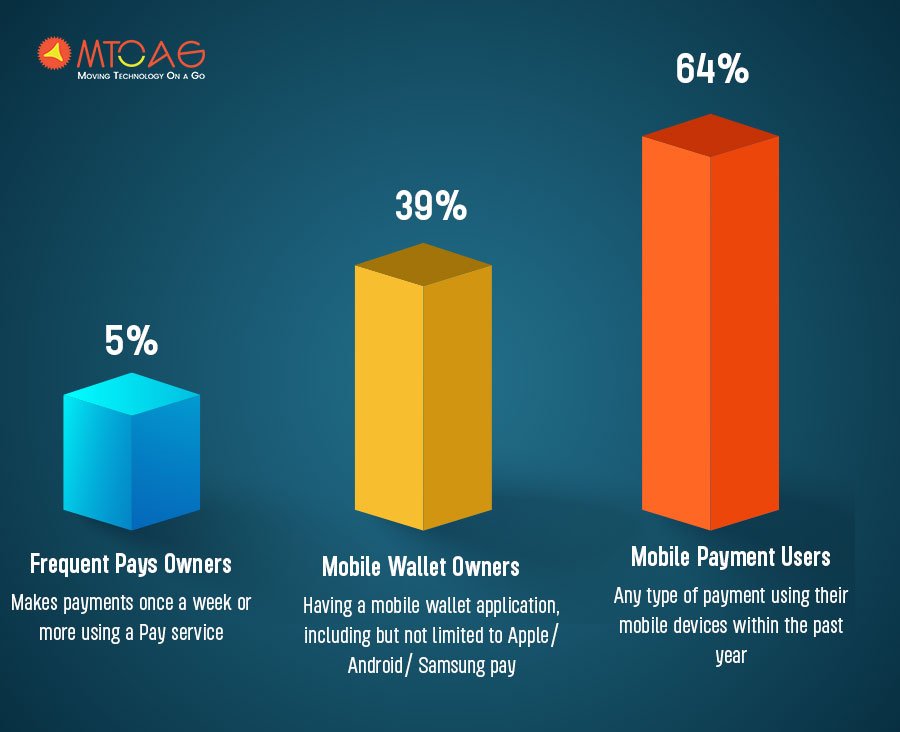

The pandemic further accelerated the shift from “cash is king” to “cash is trash.” According to recent surveys, 63% of people consider cash and card payments unsanitary, while 80% believe contactless payments are safer. These numbers clearly indicate a growing preference for digital banking. Mobile-only banking is no longer a trend—it’s the new normal. Keeping this shift in mind, we analyzed common customer concerns and industry demands and compiled our insights into this comprehensive guide.

Online banking is a frequent bank's remote service. In other terms, it's a website or app that allows customers to manage their funds and carry out various tasks. But, of course, there's always a but. Users of such applications must have a bank or financial institution account with them. That normally means they'll have to go to the bank and create an account there, especially with the more traditional banks. However, one visit will suffice, and clients will be able to continue to profit from the online version after that.

This convenient solution allows consumers to manage their bank accounts using a mobile device-compatible banking app on their smartphones or tablets. Apart from being at users' fingertips, such applications are also extremely useful in that they are available 24 hours a day, seven days a week. Aside from the rare "maintenance time off" or anything similar, they allow customers to utilize practically all of its functions around the clock, regardless of time zone. Furthermore, such solutions may provide real-time assistance via chatbots or AI-powered chatbots. Mobile banking refers to a variety of transactions carried out using digital wallets, payment channels, and UPI transfers.

This is a bank's PC-based solution for corporate customers. The banking software is installed on a PC and provides clients with smooth access to the bank's system and database, as well as the ability to make payments. Because clients must have a PC or laptop on hand, this banking option is less convenient than the mobile one.

Users may manage their accounts online using this type of solution, which runs directly in a web browser. It is ideal for busy individuals since they may access their accounts at any time and from any device. All they require is a dependable browser and a consistent internet connection. You may use internet banking to manage basic payments and major bank transfers.

This sort of banking is very new, yet it is gaining popularity as time passes. This is an online-only option that does not have a physical banking facility. The key benefit of mobile-only banks is that they have far reduced operational costs. Owners of such applications save money on rent, utilities, armed protection, office equipment, encashment, and employee compensation, among other things. For example, Robinhood barely has a customer service department, even if it is a remote one, and it was only after a teenager's death that they pledged to invest more significantly in their customer service support, as well as in improving their platform and attempting to fix bugs and glitches.

Banking services are inexpensive. As previously stated, mobile-only banks have fewer expenditures, resulting in reduced prices for their services. As a result, more individuals are opting for these types of solutions.

There is a grace period. To attract new customers, several mobile banks extend the grace period. This method works well since consumers can comprehend how everything works and what the true benefits of mobile banks are.

Higher Deposit rates. What bank customers wouldn't want better interest rates on their deposits? This trait enhances client loyalty and widens the client base.

Discounts/Cashbacks. Mobile-only banks can form partnerships with restaurants, stores, movie theaters, and other companies to provide discounts to their customers. Because it promotes business, these reciprocal offerings are helpful and profitable for all parties involved.

Discounts/Cashbacks. Mobile-only banks can form partnerships with restaurants, stores, movie theaters, and other companies to provide discounts to their customers. Because it promotes business, these reciprocal offerings are helpful and profitable for all parties involved.

Because mobile banking apps provide a wide range of capabilities and the capacity to execute a number of procedures, they have achieved widespread appeal and continue to receive excellent ratings in app stores.Bank customers don't even have to leave their homes to pay bills, manage their accounts and credit cards, obtain financial advice or help, or set up investment, savings, or retirement programs. All of this, and much more, is only possible because of the features built into mobile solutions.

As a result, we'd like to highlight some of the most important and popular features that should be included in every online bank application. Of all, technology does not stand still, so new, more complex, subtle, and intriguing features will appear from time to time. However, for the time being, the must-have feature set looks like this:

This function allows you to send money from your account to other people's bank accounts or credit cards. There is no need to visit a bank or seek for a terminal to complete this transaction. Users may handle their money online on their own. And "Venmo me" has become a slang term among millennials who use the Paypal-owned app to settle restaurant bills, as waiters typically carry a single bill for an entire group of pals.

Clients will be able to do a variety of banking tasks using voice assistants such as Siri or Google Assistant as a result of this choice. Voice recognition technology is really popular right now since it allows you to perform a lot of things without having to use your hands. In the banking industry, this technology is not yet widely used. So, if you include this feature in your solution, you may get a significant competitive edge.

It's a fantastic choice for folks who solely use cards and bank accounts to pay for everything and never use cash. This tool allows users to keep track of all their expenses and current balances in order to manage their monthly budgets, balance their books, and eventually develop a surplus. You might even include a holistic tracker where users can enter their financial saving and spending goals and receive advice from actual experts on how to achieve them.

It's a fantastic alternative that delivers a fantastic client experience. The banking app can even present unique offers available in the region at that moment based on the customer's location - food and beverage discounts, various coupons to purchase anything – depending on the customer's location. Furthermore, you may use your banking app to pay for these deals and gain cashback.

The ability to recognize images is a fantastic capability that allows your bank to go completely virtual. If you want to create an account or a new card, all you have to do is snap a photo of a valid photo ID and upload it; the difference is that, until recently, this work required the inspection and approval of an expert; today, AI can handle this task and more. Image recognition examines, analyzes, and recognizes all relevant data before providing correct results and approvals. It is also feasible to scan numerous invoices, cheques, and other documents using this smart technology.

Banking applications with a geolocation feature are designed to make finding the nearest ATM or bank office easier and to provide instructions to it. The applications can also provide up-to-date information on cash availability, hours of operation, currency conversion rates, and so on.

Ally Bank is a mobile-only banking app with better terms, including cheaper commissions and fees. This online bank is now widely regarded as the best on the market, with 43,000 ATMs and connected checking and investment accounts. Like any other bank, Ally Bank offers savings and other standard banking services such as bill payment, transaction history, deposits, and ATM locations. Furthermore, the app provides its users with the most recent financial market news. This app is compatible with both Android and iOS smartphones.

Bank of America is a significant national bank with 16000 ATMs located across the United States. Because it is a national company, clients have a great level of trust in it. It offers standard banking services as well as cutting-edge savings options. What we appreciate about this software is that it is completely safe and identifies any suspicious activity on your account immediately, allowing you to stop or freeze it. In addition, Bank of America offers rewards for certain activities. This app requires monthly maintenance, which costs $14.

Another banking behemoth with a vast network of 13,000 ATMs is Wells Fargo. It has modest checking account fees that are easily eliminated if you have a $1,500 minimum daily balance and $500 in direct deposits each month. You can simply pay any sort of bill using the Wells Fargo app, and establish your Touch-ID or Face-ID to ease the logging-in procedure. The app also has fast controls for checking the balance, reviewing transaction history, and seeing credit card information, among other things.

Banking app development needs a highly skilled team of fintech professionals. It is preferable to outsource the creation of your solution since you will save a significant amount of time and money. If you're searching for a team to design your online banking app, make sure they have the following professionals on board:Scrum Master; Business Analysts; Web and mobile developers; Designers; Software Architects; QA engineers.

You must use the banks' APIs whether you are developing an app for an existing bank or launching a banking app for your mobile-only financial institution. In the first situation, they must create an app that works and allows users to manage their bank accounts. Regardless, you should be knowledgeable about banking technology, particularly if your goal is to create a safe and functioning mobile-only banking app.

Because consumers entrust banks with their money and personal information, banking applications are the most important element. The banking app must adhere to local government rules and comply with all licenses and KYC requirements.Consider adding encryption methods, electronic signature support, and data tokenization to the technological component of the app's security. Allowing people to generate weak passwords is not a good idea, and multi-factor authentication should be used as well.

Although the majority of online banking users are younger and tech-savvy, a banking app should be designed for everyone. The interface must be intuitive, with clear navigation, readable text, and easily accessible features for users of all age groups. The color palette should remain subtle and balanced—never too bright or harsh on the eyes. Elements such as buttons, logical section flow, and loading indicators play a crucial role in delivering a smooth and user-friendly experience and must be carefully optimized.

As you can undoubtedly tell from the above paragraph, creating a mobile banking app is a lot of effort. As a result, it can't be inexpensive. A mid-sized outsourcing business would charge you between $30,000 and $60,000 for a solution of this type created from scratch, which may help you obtain maximum benefits for a very affordable price. Of course, redesigning and updating an existing online and mobile banking software will be far less expensive.

You may check your account balances and transaction history, as well as transfer funds between your CSB accounts. You may also join up for free Online Bill Payment to pay your payments fast and conveniently!

Developing a banking app from the ground up is a time-consuming and meticulous process that necessitates extensive industry knowledge. There are a few major actions you must take first:

For your protection, the system mandates that you utilize Online Banking at least once every six months. In addition, if we think your account has been compromised or misused, we retain the right to revoke your online banking account access.

Because the financial business is complex and full of legal nuances and quirks, creating a banking app is a lengthy and complicated process that can take months. It all relies on the number of functions and features included in your solution.

In conclusion,People no longer choose a bank only based on its reliability. Customers are increasingly demanding these days, and they choose institutions that make their life simpler. Mobile apps were made specifically for this purpose. Your bank can make payments easier and faster than ever before using a mobile app. Blockchain and big data are two technologies that will disrupt next-generation banking systems, but mobile banking will continue to be the emphasis for the time being.Businesses will inevitably become more digital, and the banking industry is no different. The competition is fierce, and you must provide the finest possible service to gain your customers' loyalty.People nowadays are not willing to spend a lot of time figuring out how to use a banking app. They want to be able to effortlessly access it, identify the relevant options, and execute the essential actions. That's precisely what your banking app should provide.