2500+

Successful Projects

Although the e-commerce market has grown exponentially in the past few years, the biggest nightmare for businesses remains cart abandonment. Around 9% of online shoppers leave a website before purchase due to a lack of funds at that time. However, the advent of Buy Now Pay Later (BNPL) services like Tabby seems to be solving this problem to a great extent in Riyadh, Saudi Arabia.

Tabby is basically a BNPL app that lets users buy their desired product online and split the payment into 4 monthly installments. The best thing about the app is that there’s no interest and no hidden fees. With the growing prevalence of online shopping in Riyadh, doesn’t it seem a lucrative opportunity?

Table of Contents

So, if you have made up your mind and are ready to invest in developing an app like Tabby in Riyadh, this guide will help you a lot. How? Well, we will analyze the business model of Tabby, the current state of Riyadh’s e-commerce market, and the dominance of BNPL apps, alongside discussing the key features, detailed development process, and estimated cost. So, let’s get started!

The e-commerce sector in the Middle East is expanding rapidly with technological advancements and digitalization. The region’s e-commerce market was worth $1.88 billion last year, and which is expected to grow to $10.96 billion by the end of 2033, reflecting a CAGR of 21.58%.

Meanwhile, Saudi Arabia, particularly Riyadh, is emerging as a key player in the Middle East e-commerce scene. The kingdom’s e-commerce sector ranks among the top 10 countries globally expanding in this sector, with over 40,000 e-commerce businesses registered here.

With the growing adoption of online shopping, the advent of Buy Now Pay Later (BNPL) services in Riyadh is at a record high. Let’s go by numbers:

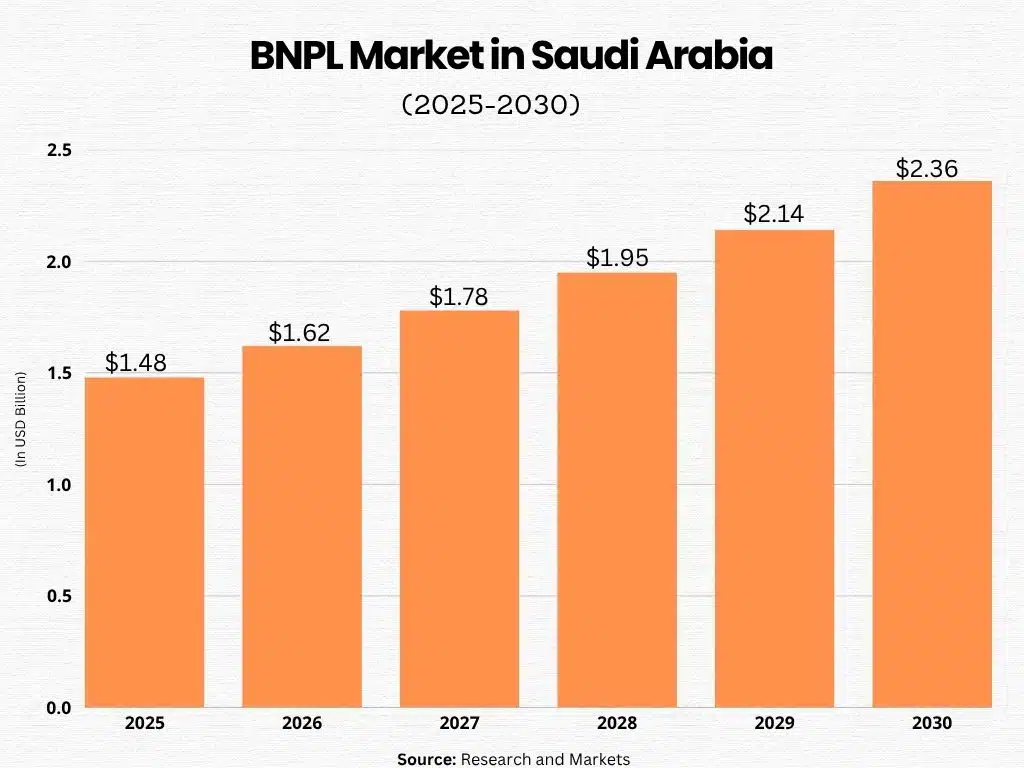

The BNPL market in Saudi Arabia is expected to grow to $1.48 billion by the end of 2026, which is further expected to grow to $2.36 billion by the end of 2030 at a CAGR of 9.7%. (Source: Research and Markets)

The business model of Tabby is based on 'Buy Now, Pay Later' (BNPL), which allows shoppers to buy their desired products from the partner site and split the payment into multiple monthly installments. They don’t have to pay the full amount upfront to buy a product. Tabby partners with online and offline retailers to offer payment options at the checkout. For consumers, it turns out to be the best buy as they can conveniently pay the amount in installments without any interest.

For merchants, it offers higher conversion rates and average order values, as Tammy entices shoppers to spend more. The payment option easily integrates with the site’s existing systems, ensuring a smooth checkout. So, if Tabby offers interest-free services, you might be thinking, how does it make money?

The revenue model of Tabby is simple: It earns through commissions from merchants. The platform charges a fixed commission for each transaction completed on the partner’s site. Additionally, it earns from customers, too. Although the app offers interest-free installment options, but failing to pay on time will incur late fees. At the same time, there are one-time processing fees and interchange fees when payment is made through a credit card.

Meanwhile, the app offers Tabby+, a value-added service that allows customers to pay for fuel, groceries, and electricity in installments. The service costs around 49 AED every month.

The growing popularity of "buy now, pay later" services has significantly increased the demand for Fintech apps like Tabby. In Particular, Tabby offers a wide range of benefits, which we have outlined below:

Developing a Tabby clone app allows you to tailor the platform to meet the specific needs of your users. This customization ensures the app is both unique and easy to use, leading to higher customer satisfaction.

A Tabby clone app is designed with a user-friendly interface, making payments quick and hassle-free. It ensures smooth transactions for both buyers and sellers while also providing a seamless, error-free experience for users.

Creating a clone app eliminates the need for extensive research and development costs. This makes it a budget-friendly option, as you can build a Tabby-like app without overspending on development.

Since clone apps are based on proven models already popular in the market, they naturally attract customer interest. By following the same successful principles and making minor adjustments to suit your target audience, you can achieve excellent results with a Tabby clone app.

If you’re serious about creating a "buy now, pay later" (BNPL) app like Tabby, it’s crucial to understand the key features that make such apps successful. Below, we have highlighted the essential elements to focus on:

Let’s start with the most important feature: login and verification. The app should allow users to sign up easily using their phone numbers or email addresses.

Meanwhile, security is a top priority, so it’s important to also ask for valid identification during the process. Only after verifying this information should the user be granted access to the app. This step ensures both convenience and safety for your users.

The app should give users the option to make payments in advance, even before the due date. This feature adds flexibility and makes the app more user-friendly, enhancing the overall experience.

A key feature of any "buy now, pay later" app is the ability to automatically deduct payments from the user’s linked credit card or bank account. However, it’s important to notify users before deducting any installment to keep them informed.

Since returns or cancellations can happen, the app should have a system to handle such situations. For example, Tabby cancels orders and stops installments once a return is confirmed. Implementing a similar mechanism in your app is a smart move to ensure smooth operations.

According to experts, many users are motivated to make repeat purchases when they can earn cashback or reward points. Including a cashback feature in your BNPL app is a great way to attract and retain customers. This strategy is widely used by successful platforms to create a seamless and rewarding experience for users.

A high-quality app like Tabby comes with a powerful account management system. This feature lets users easily track their purchases, view past payments, and check upcoming installments. It also securely stores users’ personal details for a smooth experience.

For a BNPL app to succeed, seamless integration with merchants is essential. The app should work effortlessly across devices and support integration with various e-commerce platforms, ensuring a smooth shopping experience.

To cater to diverse user preferences, the app should integrate multiple payment networks. This includes supporting various payment methods and enabling quick, hassle-free money transfers for users.

Push notifications and alerts are key features in BNPL apps. They keep users informed about updates, payment reminders, and other important information, boosting engagement and helping retain customers.

This feature is designed specifically for merchants, offering them tools for reporting and analytics. It allows merchants to collect data and use it to improve customer engagement and decision-making.

By integrating APIs into your app, like Tabby, you can strengthen relationships with merchants. This feature enables smooth data exchange between the app and servers, ensuring efficient communication and functionality.

The instant credit check feature is a must-have for any BNPL app. It allows users to quickly check their credit eligibility within the app, ensuring fast and seamless transactions.

Including a customer support feature ensures that users can get help whenever they face issues with the app. This builds trust and keeps users confident in the app’s reliability.

Have you wondered what makes apps like Klara and Tabby top the charts in BPNL categories? It's their advanced features and technology that make it happen. The more advanced your app is, the more users it will manage to garner.

Here’s a table showing the required technology stack for developing a BPNL app like Tabby:

Category | Technologies |

Frontend Development | JavaScript, TypeScript, React Native, Flutter |

Backend Development | Java, Kotlin, Swift, Objective-C, Spring Boot, Node.js, Express.js |

Payment Gateway Integration | Stripe, PayPal, Square |

Cloud Infrastructure | AWS, Google Cloud, Microsoft Azure |

Security and Compliance | OAuth, JWT, SSL/TLS encryption, PCI-DSS, GDPR |

Data Analytics and AI | Apache Kafka, Apache Spark, TensorFlow |

Customer Authentication and Credit Scoring | Integration with third-party services for credit checks, TransUnion, Experian, Equifax |

Installment Management and Scheduling | Custom modules for managing payment plans, Apache Airflow |

Fraud Detection and Risk Management | Machine learning models to detect and prevent fraudulent activities, Scikit-learn, Keras |

Merchant Integration | APIs for seamless integration with merchant systems, RESTful APIs, GraphQL |

If the above information encourages you to build your own BNPL app like Tabby, it’s time to act fast. Here’s a detailed BNPL mobile app development lifecycle to make you understand the process more precisely:

To build a successful BNPL app, start by understanding what users need. Conduct surveys and focus groups to gather insights into their expectations. Also, study competitors like Afterpay, Postpay, Tamara, and Affirm in the UAE to see what works and what doesn’t.

Your app needs a clear USP (Unique Selling Proposition) to stand out. For example, Tabby’s USP is: “Tabby lets you split your purchases into 4 monthly payments so you can worry less and aim for more.”

Think about how your app can offer something unique or better than competitors. A strong USP helps create a memorable brand and attracts users. Focus on what makes your app different and valuable to your audience.

Focus on selecting features that are both in demand and feasible to develop. Prioritize what users need most and ensure your team can deliver them effectively. Create a clear roadmap with timelines and milestones to guide the development process.

Key features to include:

Begin with wireframing and prototyping to map out the app’s flow. This helps you visualize how users will navigate the app. Conduct user testing to gather feedback on usability and make improvements based on real user input. Aim for a clean, intuitive design that ensures easy navigation, similar to apps like Tabby, to enhance user satisfaction.

Choose the right technology stack that fits your app’s requirements. For the front end, create responsive and user-friendly interfaces to ensure a smooth experience across all devices. Use a scalable framework to support future growth and follow secure coding practices to protect user data.

Collaborate with reliable payment providers to ensure safe and secure transactions. Include support for multiple currencies to cater to users from diverse backgrounds in the UAE, making the app more accessible and convenient.

When selecting payment gateways, look for:

Familiarize yourself with the licensing requirements in the UAE and obtain the necessary approvals to operate legally. Clearly outline your app’s terms and conditions to inform users of their rights and responsibilities. Consult legal experts to navigate regulations and draft transparent user agreements, which will help build trust with your users.

Start by conducting functional testing to make sure every feature works as intended. Perform performance testing to ensure the app runs smoothly, even during high traffic or peak usage. Security testing is essential to identify and fix vulnerabilities, keeping user data safe. Automated testing can speed up the process and simulate real-world scenarios to check how the app performs in everyday use.

Begin with a soft launch by releasing the app to a small group of users for beta testing. This helps gather feedback and fix any issues before the full launch. Once the app is polished, release it on major app stores like Google Play and Apple App Store to reach a larger audience. Keep a close eye on user feedback during the beta phase and plan marketing campaigns to generate excitement and awareness around the launch.

By now, we have covered the business model and development process of Tabby. Now, let’s understand the costs involved in building a similar app. Partnering with a trustworthy mobile app development company in Riyadh can significantly impact both quality and budget. However, understanding the factors that influence development costs is equally important.

The front-end and back-end form the core of any app and typically require 400–800 hours of development work, depending on the app’s complexity. In the UAE, development rates average between AED 220 to AED 240 per hour, putting the basic development cost in the range of AED 88,000 to AED 192,000.

Feature complexity plays a major role in determining the total cost. Advanced features like real-time analytics, personalized recommendations, and automated payment reminders can increase development time and add anywhere from AED 37,000 to AED 110,000 to the budget, depending on the features you choose.

Designers spend a lot of time crafting user experiences to ensure satisfaction. A well-planned and visually appealing user interface makes the app smoother and more engaging. Typically, this costs between AED 18,500 and AED 55,000.

Other branding elements, like logos, icons, and visual assets, are also crucial for creating a recognizable identity. These design components usually range from AED 7,500 to AED 30,000, depending on their complexity and scope.

The timeline for development significantly impacts the cost. Rushing the process may require additional resources, increasing costs by 20% to 30%. A standard development timeline ranges from 4 to 9 months, depending on how complex the app is.

Payment gateways are essential for secure transactions. These services come with integration and transaction fees, depending on the provider. Budget around AED 11,000 to AED 37,000 for these costs.

APIs and services that add functionality, like geolocation or user analytics, also increase expenses. API integration typically costs between AED 7,500 and AED 18,500, depending on the features needed.

Licensing is a must for financial services in the UAE, with government fees usually ranging from AED 18,500 to AED 55,000. Obtaining the right licenses ensures compliance and builds user trust.

Legal advice is also important for creating terms and conditions and privacy policies. Allocate around AED 7,500 to AED 18,500 for legal services to meet UAE regulations and draft clear user agreements.

Pre-launch campaigns are key to generating awareness. Activities like social media ads and influencer collaborations generally cost between AED 11,000 and AED 37,000.

Ongoing marketing is crucial for attracting new users and keeping existing ones engaged. Plan to spend AED 3,700 to AED 18,500 per month on continuous advertising to support the app’s growth.

Technical support is essential for resolving user issues and keeping the app running smoothly. Monthly technical support costs typically range from AED 3,700 to AED 11,000.

Regular updates and feature improvements are necessary to stay competitive. Annual costs for updates can range from AED 18,500 to AED 55,000, depending on the extent of the changes.

The size and expertise of your development team affect the overall cost. Local developers may charge higher rates but offer a deeper understanding of the UAE market. Outsourced teams can be more budget-friendly but may require more effort in communication and coordination.

The BNPL market in Riyadh is evolving quickly, requiring constant innovation to meet user demands. Regularly updating your app based on user feedback is key to staying relevant. Adding new features like flexible payment schedules or loyalty programs can help keep users engaged and loyal.

Tabby’s success is greatly due to its consistent updates, showing it listens to its users. By following a similar approach, you can retain users and build a strong reputation in the competitive UAE market. These strategies offer a clear path to establishing your BNPL app as a trusted option in the UAE, setting the stage for growth in this booming industry.

At Mtoag Technologies, we specialize in turning ideas into reality through innovative app design and development. Our team is experienced in the UAE market, understands local regulations, and knows consumer behavior and trends, making us the perfect partner to help you launch a successful BNPL app in the region.

Yes, Tabby is available in Saudi Arabia. It is a popular buy-now-pay-later service that allows users to shop at various retail partners and pay in installments or later, making it convenient for shoppers in the region.

Eligibility for Tabby typically requires users to be residents of supported countries like Saudi Arabia, have a valid ID, and meet age requirements (usually 18+). Users must also have a valid payment method and a good credit history to qualify for installment plans.

Yes, Tabby is safe for installments. It is a regulated financial service provider that uses secure payment systems and encryption to protect user data. However, users should ensure timely payments to avoid late fees or penalties.

The limit for Tabby installments varies based on the user’s shopping history, creditworthiness, and the retailer. New users may start with a lower limit, which can increase over time with consistent and responsible usage.

Yes, you can go on vacation while having Tabby payments. However, ensure your payments are up to date or set up automatic payments to avoid missing due dates, which could result in late fees or impact your credit score.