Trusted By 650+ Happy Clients, Including Fortune Companies

What Our Clients Say

Awards and Accolades

Insurance Mobile App Development Services

In this modern era of world where all the communication takes place via mobile phone, insurance mobile app development was one of the biggest challenges that insurance companies were facing. However, with the insurance mobile app development, the solution makes it possible for the customer to collect all the details related with the life insurance policy. Have a quick simulation by easily applying through an app using smartphone or if registered a policy holder can simply check the details while on a go.

An insurance mobile app development can improve customer experience by bridging the gap between policyholders and insurers through fast response and easy access to information.

Members

Take a Look at Our Portfolio and Discover App Ideas Brought to Life

We Don't Just Use Technology; We Live It! Our dedicated team of experts creates innovative mobile app solutions that empower businesses and transform ideas into reality. Check out our portfolio and experience the difference between working with a team that truly understands and embraces the power of technology.

Healthcare App

An app that allows you to grow your dairy business and migrate it online.

Staffing Payroll Software

An app that allows you to grow your dairy business and migrate it online.

Taxi App Development

Best Taxi App Development Company

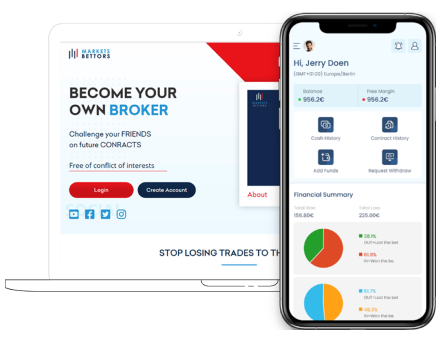

Online Trading Application

One of our old clients needed a customized trading application with focus on crypto currency

Money App

The oldest insurance company of Lebanon reached out to us.

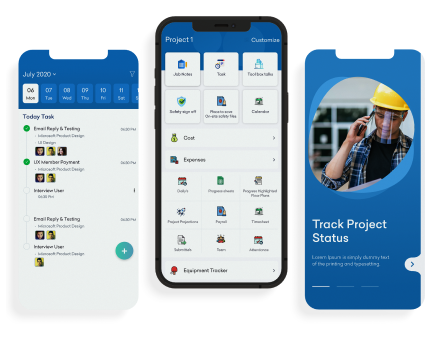

Construction Project Management Software

PlanTech, a well-established US based construction company with huge projects

Milk Delivery App

An app that allows you to grow your dairy business and migrate it online.

On-Demand Delivery App

A construction company reached out to us to build

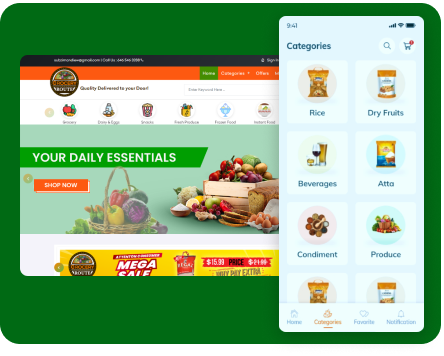

Grocery Delivery App

They didn’t have a clear vision but had a determination to move online digitally.

Staffing Agency Software

ChampHR, a US based staffing agency, reached out to us to digitize their business.

Our Insurance Application Development Capabilities

01

Life Cover Required Amount

Our app enables the policyholder to choose the life cover amount required and the premium that suits them.

02

Frequency of Payment

The customer will have the flexibility to choose the option of monthly, quarterly, semi-annually or annually pay the premium.

03

Interest Calculator

The app automatically calculates the interest rate per minute which the user can easily check

04

Premium Payment Reminder

The policyholder will receive reminders to pay the premium so there are no delays in payment.

05

Flexible Payment Mode

There are multiple payment options available to the customer. Additionally, the policyholder can easily add/withdraw money to the account and even lend money to a friend.

06

Flexible Payment Mode

The policyholder can directly connect with the customer support department of the insurer and get a resolution for their issues without any hassle.

Want to Hire Insurance Mobile App developers for your Project ?

The Must-Need Features of an Insurance

Depending on the business goal, an insurance application's functionality may differ. However, there are certain features that need to be there, no matter what the architecture. In case you have additional requirements, we'll help you in determining your MVP's must-need features-set.

- Financial Records and Account Balance

- Payment and NFC Integration

- Security Protocols and Encryption

- Wearable Devices Integration

- Customer Experience & User interface Design

- Biometric Verification

- Wallet

Our adept Insurance Mobile App developers deliver the best-fit solutions to your unique project requirements

We have specific Insurance App Development solutions for you

Ease & security

Helping customers enroll policies within a minute with secure payment facility.

Manage policy holder data

Manage customer basic & vital information like profile, bank, insurance account information, etc

Better interface

Allow better user interface in terms of checking outstanding balance, available credit, etc.

Integration with the existing system

We ensure with the clients that there are no data corruptions or leakage issues.

Emerging Solutions

Insurance Comparison Platforms

We create user-friendly platforms that help customers in comparing various insurance products so that they may purchase the optimum insurance plan for them based on their age, risk components and other parameters.

Predictive Analytics Software

This is one of the most popular emerging technologies used by insurance companies where they identify customer behaviour using smart data technology.

Payment Processing Software

We build advanced solutions for insurance companies to help them process and reconcile various online and offline payments such as debit/credit card transactions.

Agent portals

We build web portals for insurance agents to help them keep track of their clients, leads, insurance policies, incentives, earnings. Our portals also keep them informed and educated with the right information.

Healthcare app development

Mtoag Technologies creates a functional and engaging healthcare app using the latest technology for your business. Talk to our expert.

Why Mobile Apps for Healthcare is Necessary Today

Learn & watch every thing about Healthcare Mobile Apps via this simple video. Create your own Healthcare Mobile Apps with Mtoag's highly motivated app developers.

Looking for Other Services?

Explore our other related services to enhance the performance of your digital product.

Latest Technology News And Blog

Discover All That's Trending In Technology, Business, Enterprises, And Outside