2500+

Successful Projects

"Investing in oneself is the finest investment you can make… the more you learn, the more you'll earn" – Warren Buffet.

Financial literacy is the ability to handle your finances, including debt repayment, retirement planning, and budgeting and saving.

It gives you the information you need to make wise choices that improve your quality of life, reduce stress, and increase financial security. Table of Contents

Being financially literate gives you to manage your money and take advantage of new chances and challenges.

It is essential to obtaining financial well-being.

The cognitive comprehensive of financial concepts and abilities, including borrowing, investing, budgeting, taxes, and personal financial management, is known as financial literacy. To be financially illiterate is to lack these kinds of abilities.

The Financial Industry Regulatory Authority (FINRA) estimates that over 65% of Americans lack basic financial literacy.

A financially educated person is less likely to experience personal financial hardship because they may anticipate certain financial obstacles and be better prepared for them.

Today's culture values financial literacy highly because of commonplace financial products and services, including credit cards, mortgages, student loans, investments, and health insurance.

Financial literacy encompasses several financial elements and proficiencies that enable a person to understand the efficient handling of finances and debt.

The essential elements of financial literacy and finTech app development guide that need to be understood are listed below.

The four primary uses of money that establish a budget in budgeting are giving away, saving, investing, and spending.

Maintaining a healthy balance between the significant uses of money enables people to utilize their income more wisely, leading to prosperity and financial stability.

Generally speaking, a budget should be set up so that all outstanding debt is paid off and funds remain for savings and wise investments.

A person has to become financially literate by learning about the essential elements of investing. To guarantee profitable investments, one should become knowledgeable about several factors, including interest rates, price ranges, diversification, risk management, and indices.

A person has to become financially literate by learning about the essential elements of investing. To guarantee profitable investments, one should become knowledgeable about several factors, including interest rates, price ranges, diversification, risk management, and indices.

By being knowledgeable about the essential components of investments, people may make more informed financial choices that increase their income.

Virtually everyone has to take out a loan at some time in their lives. Understanding interest rates, compound interest, time value of money, payment terms, and loan structures is essential to ensuring successful borrowing.

If people fully comprehend the requirements, their financial literacy will rise, which will provide helpful borrowing advice and lessen long-term financial strain.

Financial literacy requires understanding the various taxation systems and how they affect an individual's take-home pay. Every kind of income –employment, investments, rentals, inheritances, and unanticipated –is subject to a distinct tax rate.

Understanding the various income tax rates promotes financial performance via income management and allows for economic stability.

The most crucial criterion, personal financial management, combines every element mentioned previously.

In order to strengthen and grow investments and savings while lowering borrowing and debt, financial security is achieved by striking a balance in the mixture of financial components mentioned above.

A thorough understanding of the financial elements covered above ensures that a person's financial literacy will rise.

One of the most crucial things a person can do to guarantee long-term financial security is to become financially literate.

Based on the results of the market research and extrapolating these findings to the overall number of affordable private schools and children enrolled in such schools, we have estimated total market demand of USD 4.4 billion for education finance products in India.

The following real-world data should highlight the importance of becoming financially literate overall.

The figures above make clear why financial literacy is so crucial in the current economic environment.

"I believe there's an app for that" is a common expression that most people have heard or used. While you're discussing one of life's many annoyances, one of your pals solves the topic by mentioning an app they've used to address the same issue in their own life. There may be an app for anything from figuring out what music is playing in the bar to determining whether the surf is safe to go on vacation to recognizing the trees in your garden.

This holds for everything related to money. Because you interact with apps and money on a daily basis, they make a perfect combination. The easier it is to access them, the better. You always have your smartphone with you, so you have plenty of time to keep track of your funds and expand your financial literacy. Finance applications enhance financial literacy. Because of the flexibility of app technology, there are now quizzes, games, financial news, help with budgeting, and much more. Regardless of your age group, a particular area of concern, or everyday requirements, we want to assist you in finding the appropriate applications for your scenario.

Making a reasonable budget is one of the most crucial things we can do with our money. We are more likely to live the lives we want when we better understand our monthly income and expenditures. Budgeting may be complicated when you first start. You still need to create your spending strategy even if you've studied all the recommended literature on the topic. Apps make sense in eliminating this step by providing you with an expertly developed foundation and then instructing you on how to utilize it best to fit your needs. Ultimately, these applications may successfully instruct you on how to converse money.

YNAB assists you in managing your money by generating a budget that meets your daily requirements. Reduce debt, boost savings, and expedite the completion of your financial objectives. New budgeters usually save up to $600 in their first two months and over $6,000 in their first year, on average, according to YNAB.

Approximately 25 million people use Mint, one of the most well-liked money-saving applications currently available. It is entirely free and helps users of all skill levels manage their money. With only one financial app, you can connect your bank account to check your balance regularly, set up rent reminders, and check your credit score.

With Wallet, you may access all the typical features of a budgeting tool. Be mindful of your earnings and outgoings, and always maintain a summary with precise data. Moreover, you can use the software to digitize well-known loyalty cards like Payback and make shopping lists.

Apps may provide a more current viewpoint, even though news sources help monitor the stock market. Not only that, but you may customize your stock portfolio using the appropriate software. This enables you to ignore the commotion in the stock market and concentrate on your assets.

Yahoo Financial is an app for monitoring stock market developments and investments. You can also get daily financial news from them on their website. To get through the noise, find our specific financial facts, such as past financials, ESG ratings, and top holdings. Subscribe to certain stocks, markets, or sectors to get individualized news and real-time trends.

Ellevest was created by women, for women, to support more female users in becoming financially savvy and independent. The program, which won the 2021 NerdWallet award for "Best Robo-Advisor for IRA Investing," provides users with seminars, online coaching sessions in small groups, and educational resources on wage negotiating, budgeting, and saving.

Like Yahoo Finance, this app supports the well-known news site by providing users with a mobile app that informs them about portfolio management and stock market movements. Investing.com offers customized alerts and notifications, a calendar view to monitor market movements and how they affect assets, and a personal news feed to help users maintain constant financial literacy.

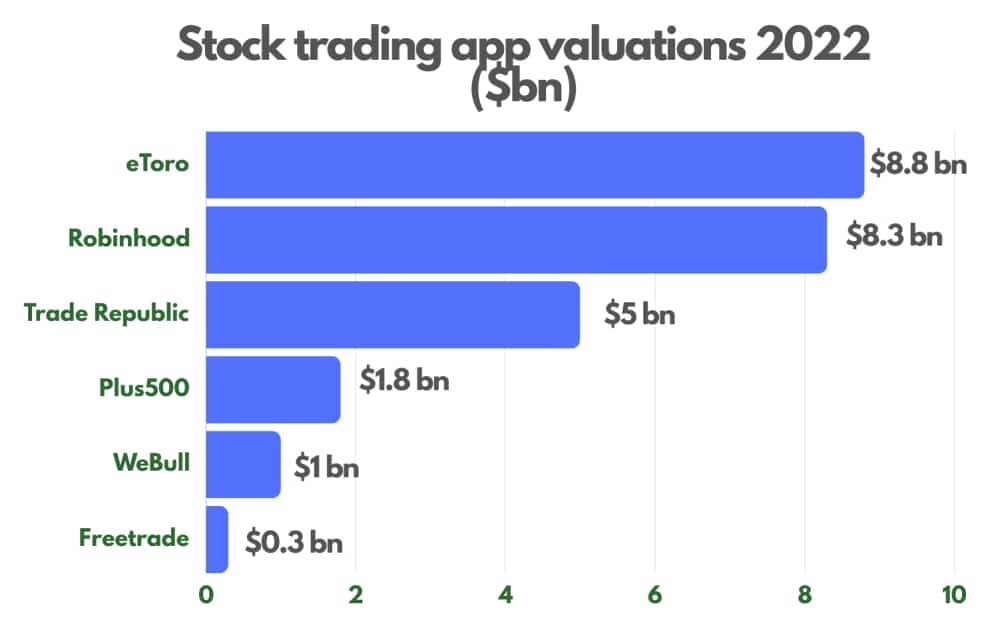

There are many more apps that helps to learn stock and Investing apps and which have billions of market size. So, let’s know them with a graphical presentation.

While books and podcasts may provide you with a wealth of information on specialized financial issues, finance applications designed to increase your financial literacy using a different strategy, these applications encourage you to learn actively by providing games on critical terms, quizzes on economic subjects, and a history of your financial literacy. You may increase your financial literacy without realizing it by scheduling time on these apps during your commute or while waiting at the doctor's office.

One of the top applications for financial education is called Zogo. Complicated subjects are simplified into enjoyable and manageable modules, making learning more straightforward in the midst of your hectic daily schedule. You obtain incentives for completing courses via agreements with various financial service providers and businesses. These benefits ultimately aid in improving your financial management.

Ascendr is a mentoring website that helps users locate a mentor on a certain subject or even teach their talents to mentees who are looking for guidance. Nevertheless, Ascendr provides you with individualized lessons and mentorships to raise your financial literacy and manage your money since it includes sections for investment and money management as well.

In addition to developing an app to raise women's financial literacy, Your Juno also builds a community in which they can connect and share ideas. Users may learn from recognized specialists by taking specific courses, quizzes, and action-oriented lists that they can apply immediately to their daily lives. Alternatively, as the creators of Your Juno put it, "Consider us as Duolingo meets Masterclass."

Even if managing your money may not be all fun and games, you can still have some fun, right? These banking games are more than pass the time; they include real-world-applicable tasks and difficulties. They're an excellent method to work through issues and role-play situations without any repercussions, allowing you to learn from your errors without paying a heavy price.

The SIFMA Foundation, which offers financial education programs and resources to improve economic possibilities and people's understanding of their money, created this gamified education app. Users may use the program to invest in a fictitious virtual stock market to apply the lessons they learn to their actual financial literacy.

In the simulation game Fortune City, you may assume the position of a city major who must manage your own money in addition to making wise financial choices to maintain the economy. Watch your expenditures and expand your virtual city at the same time! Fortune City lets you see your city grow into a stunning metropolis, tracks your revenue and spending, and gamifies accounting.

Clarity is the cornerstone of UX design for financial literacy. To guarantee that customers can access and understand their financial information without needless complications, designers should create user interfaces that are intuitive and simple to use.

Let's look at a live use case that demonstrates how we implemented the fundamental idea of clarity in financial literacy UX design.

They were improving the clarity of a Lending App's Profile Page Design. Because the current interfaces were disorganized, it was difficult for users to find and comprehend essential data, including beneficiary, bank, and Aadhaar numbers.

Our objective was to include the most critical information and display it understandably.

Unambiguous Information Hierarchy

Aadhaar and PAN numbers were prioritized over other information in a clear hierarchy we first established on the profile page. These vital identity facts were placed in easy-to-see parts, making it possible for individuals to find them quickly when they accessed their profile.

Simplified Design

For improved readability and usability, we used a simplified design for the profile page. The beneficiary, bank, and basic information were arranged into various sections that were all aesthetically pleasing and had clear labels. This method allowed users to locate the exact information they were seeking with less clutter.

Unified Design Language

The profile page was designed with a unified style that used uniform fonts, colors, and layouts. Thus, uniformity reduced visitors' cognitive strain and made the website easier to navigate, improving usability and clarity overall.

We satisfied user demands by giving clarity priority while designing our P2P lending app's profile page and creating a sound and smooth user experience. The guidelines used in this instance may provide a foundation for designing interfaces that prioritize clarity in various financial literacy apps.

Incorporating instructional elements directly into the user interface is an effective tactic. Users may improve their comprehension of financial concepts with the help of interactive budgeting courses and educational pop-ups that define investing jargon. By integrating information into the platform, users are better able to acquire fundamental financial knowledge and confidence, from comprehending investing strategies to grasping the fundamentals of budgeting.

Infographics, graphics, and ad charts are examples of visualizations that help simplify complicated financial data so that information may be presented easily for viewers to understand. Simplifying complex financial data may comprehend their financial condition; UX designers should fully use these technologies to display information in a visually attractive and easily understandable manner.

Include functions that offer individualized financial advice in response to user behavior. Customizing recommendations for each user increases the information's relevancy and effect, whether it's advocating investment diversification, setting savings targets, or providing budget optimization guidance.

Users who get timely alerts are more likely to be aware of their financial activities since they are notified about essential transactions, impending expenses, and possible problems.

The special duty of user experience designers is to close the knowledge gap between users and financial literacy. This obligation consists of:

Designers ought to be open and honest when presenting pertinent financial data. Fees, terms, and conditions should be communicated in plain language without any ambiguous or concealed details. Make sure that crucial information is not lost in the tiny print and communicate ideas clearly.

Domain educators are essential to creating financial apps because they provide pedagogical skills, curriculum design experience, and knowledge of learning goals unique to the finance domain. They also ensure that the software complies with academic requirements, making it useful and relevant for students.

Teachers contribute dynamic, interesting information that is suited to students' requirements as part of their instructional design. Additionally, they support the creation of evaluation instruments, monitor learners' advancement, and enhance learning results.

Moreover, educators offer comprehensive assistance with a range of financial issues, including budgeting, home purchasing, education savings, tax planning, insurance, and retirement strategies. They also analyze investment accounts, make investment recommendations, and develop individualized financial plans.

Their participation guarantees that the software is helpful for effective learning and is informational.

Technology specialists are essential to creating financial applications because they provide the in-depth technical knowledge and experience to develop reliable, cutting-edge apps.

These professionals ensure that the app is created using the latest technology and industry best practices, ensuring scalability, security, and effectiveness.

They help put cutting-edge features like data visualization, real-time updates, and customized financial plans into practice, which improves the app's overall usability and usefulness.

Technology specialists assist in optimizing the app for various platforms and devices, guaranteeing a consistent user experience across devices.

Their participation is crucial to ensure that the app functions well, loads quickly, and is free of errors and hugs, all contributing to creating a superior financial app.

Determining the success of financial literacy programs requires measuring the effects of financial education. It is difficult to determine if the program is accomplishing its goals in the absence of impact measurement. To fully comprehend the program's efficacy, measuring financial education's influence from several perspectives is necessary. Programs for financial education may be evaluated using a variety of metrics, such as immediate and long-term results. The Federal Deposit Insurance Corporation, or FDIC, has been instrumental in advancing financial literacy and education, and one of its main goals is to assess the effects of financial education.

The following are some methods for assessing the influence of financial education:

An established method for assessing the effects of financial education is the use of pre-and post-tests. These assessments evaluate participants' economic literacy before and after the financial literacy program. The difference between the two ratings may indicate the program's efficacy.

These provide an additional means of gauging the lasting effects of financial education. These surveys, which evaluate participants' financial habits and decision-making, might be carried out six months or a year after the program.

Credit scores may assess the effect of financial education on financial behavior. Changes in financial behavior, such as making on-time bill payments, cutting debt, and saving more money, might be reflected in credit ratings.

Financial coaching may be used to gauge how financial education affects people's ability to make sound financial decisions. Participants' progress may be monitored by financial coaches, who can also provide comments on their financial habits.

Numerous studies have shown the enormous influence that financial education programs may have on participants. For instance, participants in financial education programs had better credit ratings, were more inclined to save money, and had larger emergency reserves, according to a National Endowment for Financial Education research study. Financial education programs also boosted participants' confidence in their ability to make sound financial choices, according to another FDIC study.

Determining the success of financial literacy programs requires measuring the effects of financial education. A variety of techniques, including credit ratings, follow-up questionnaires, pre-and post-tests, and financial coaching, may be used to gauge the effect. Organizations like the FDIC can better their financial literacy initiatives and fulfill their objective of encouraging financial education and literacy by measuring the effectiveness of their financial education programs.

Being financially literate is an essential ability in modern society. In addition to improving financial health, it gives people more self-worth, eases stress, and increases security. Budgeting, saving, investing, planning for retirement, managing debt and risk, and comprehending financial ideas and products are all part of it.

Through independent research, formal schooling, consulting a professional, and networking with others, you may raise your level of financial literacy.