2500+

Successful Projects

Stock and financial markets around the world are getting battered as everyone is feeling the heat in the aftermath of Corona virus. And according to market experts, the worst is yet to come. The fallout of the economic downturn around the world has been under added pressure as the price war between the USA, Russian, and Saudi Arabia suddenly escalated. So, what does it all mean for the investors, especially the ones who don’t own much?

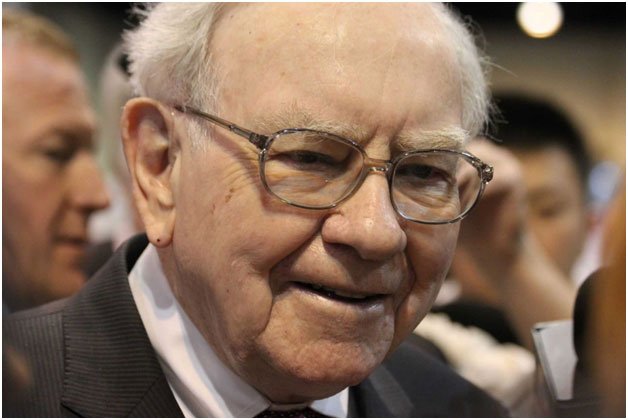

Big investors, somehow, break-even after a massive loss as they buy other stocks on profitable prices. People who have invested their life savings in the market are the ones who get a pounding as a result. Warren Buffet is one of the most respected and successful investors for the last five decades. The “Oracle of Omaha,” as he is widely known, is like an authority on stock investing, and seldom has his prediction or advice gone wrong.

It is the different leadership styles of the top CEOs and businessmen, and the high caliber that makes them successful and Warren Buffet is no unusual. So, what advice can you get from the arguably the most experienced investor in the stock market in the current scenario?

Let me offer his four tips that you can use in desperate and difficult times to get ahead of the pack without being too risky in your approach.

This is probably the most popular and essential advice from the stock guru. Warrant Buffet is of the view that when everyone looks fearful, it is time for you to get greedy. Seems quite straightforward but very difficult to swallow. How can we be greedy when everyone else is looking for shelter under a bear market where virtually every share is falling left, right and center. So how can it be beneficial for anyone?

Let me offer you an example which will make you understand this aspect easily.

Think of two stocks, one, a technology stock that you are holding on to for the last couple of years, and there is another stock related to a pharmaceutical. Both shares are falling like nine pins, and you want to make yourself safe in this market. Here you need to but the pharmaceutical share after a dramatic 3 or 4 days of a selloff. You also need to let go of your technology stock as the price will no longer be suitable for anyone. And the long-term return of its share price to normalcy looks out of place.

On the other hand, there will be added interest for pharma shares as the vaccine for Corona virus can be a real boon for them. Even a little optimistic person will be inclined towards buying this share. The dwindling price is undoubtedly a negative factor but be greedy here! And that’s where you will find out that a share looking bleak can be the jackpot for you in the near future!

This is another strategy that always works, and Warren Buffet is the biggest supporter. One of his most famous quotes related to this is, “Our favorite holding period is forever.” While you may think that there are several reasons for which a long-term holding of any stock is akin to take a significant risk. In such a volatile market, there is every reason to be afraid as currently no bottom out scenario is in sight as big and small shareholders are selling everything in a hurry.

You can invest in ecommerce store or hire web Design Company to build your online shopping store. Investing in our favorite stock for the long term is what we all long for. But yes, individuals and companies look for a solution through which they can make this task easy and secure. Companies and individuals need to select a product or service that is right on the money and has some potential in it. Buying a stock for the long term doesn’t mean that you can buy any stock with no research whatsoever.

A long-term investment is all about making an effort in the right direction, so you need to be cent percent sure about it. Do a lot of research and analysis as in a bear market, like currently, we are experiencing, and anything can go further wrong and can make an investment feel more like a liability for years than yielding anything.

You may think, why any of the advice Warren Buffet has for stocks offers looks like a sane one? This is because investment in the stocks or financial markets is not a straightforward or 1+1=2 affair. Market research about buying a share can be complicated to understand, and even market sentiments can go terribly wrong in the wake of a global event like Corona virus.

If you think about buying a stock that you always wanted to purchase and is currently available at a very attractive price, you must have some cash in hand. While you can get some money in hand by selling off some stock anyway, the prices of stocks fluctuate wildly, and within a day or two, a stock looking attractive may go out of your reach.

You can’t be greedy without some hard cash in your hand. Small businesses and startups need to think about coming up with drastic measures to streamline their operations so that they are never out of cash whenever they need to buy anything from it. Getting money in hand like 10K to 50K can be hard to get but through a reliable task management tool like Task Que, through which they can make the daily operations smooth, cut back on unwanted costs and ultimately save some money daily. We providing business robust solutions for web application development services. and get everything you need. We have a team of experts who is always ready to help you.

Dealing in stocks in such a volatile and especially bear market is akin to playing with fire. Even calculated risks in this concern can back fire big time. That’s precisely why this post has been written to offer readers some knowledge from the seasoned stock guru, Mr. Warren Buffet.

If you think you can add something valuable to this blog or want to ask something that you haven’t understood, you are more than welcome. Please use the comments section below in this concern.